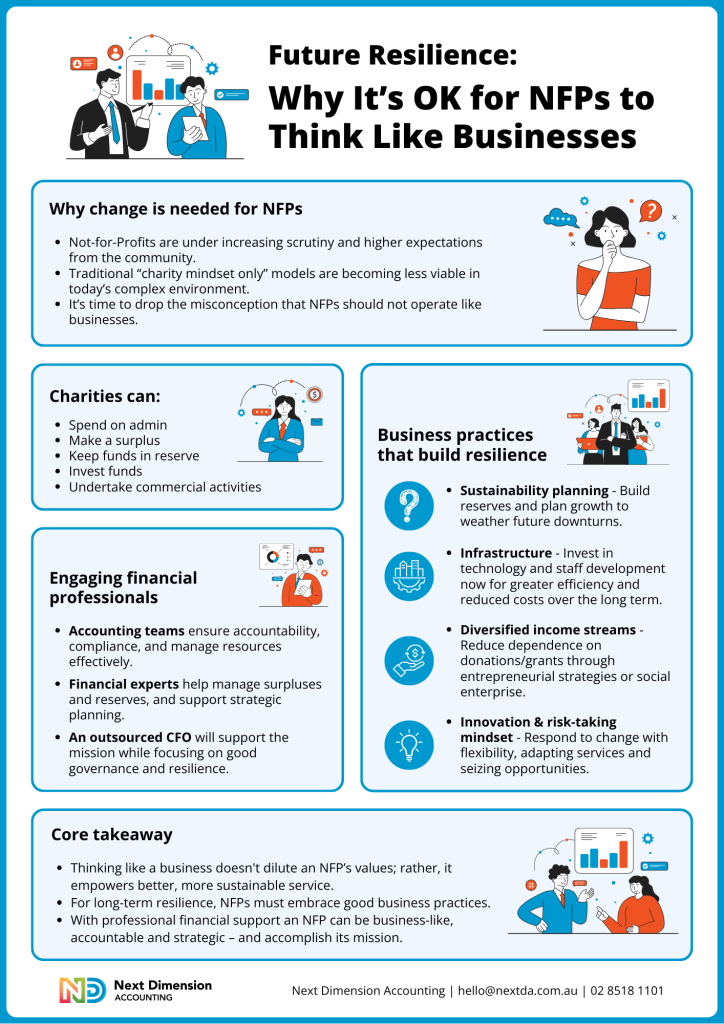

As the philanthropic landscape evolves, Not-for-Profit (NFP) organisations are facing heightened scrutiny and rising expectations. The Productivity Commission’s report Future Foundations for Giving highlights that NFPs are subject to “new scrutiny because of changing community expectations and standards.”

In response to these pressures, many NFPs are rethinking how they operate, particularly when it comes to financial sustainability. The idea that NFPs should remain entirely distinct from business practices is outdated and increasingly unviable in today’s complex and competitive environment.

NFPs, like businesses, must think strategically to ensure their long-term success and resilience. This shift in mindset doesn’t undermine an organisation’s core values or mission; instead, it enhances its ability to serve communities and meet growing needs.

NFPs Can and Should Think Like Businesses

A persistent misconception is that NFPs must operate with a charitable mindset that is removed from the financial and operational strategies used by businesses.

The Australian Charities and Not-for-profits Commission (ACNC) has recently directly addressed these misconceptions, encouraging NFPs to think strategically about their financial practices. The ACNC clarifies that:

- A charity can spend money on administration.

- A charity can make a surplus (profit).

- A charity can keep money in reserve.

- A charity can invest its funds.

- A charity can undertake commercial activities.

These facts underscore that, like businesses, NFPs need the flexibility to manage their funds, plan for future growth, and invest in their own infrastructure. By adopting practices such as building reserves, making smart investments, and creating diversified income streams through commercial activities, NFPs strengthen their financial resilience. This business-like approach is not only permissible but crucial for long-term sustainability.

The Influence of Uncharitable

This evolving perspective is reflected in the documentary Uncharitable, inspired by Dan Pallotta’s groundbreaking TED Talk, which challenges conventional ideas about nonprofit work. Pallotta argues that to enable NFPs to drive change truly, we must remove the outdated constraints placed on them.

The Role of Business Practices in NFP Resilience

Incorporating business principles into the operation of NFPs does not detract from their core mission; instead, it bolsters their ability to deliver on that mission. By adopting a more business-like approach, NFPs can:

- Plan for Sustainability: Surplus funds should not be seen as a sign of greed but as an opportunity for growth. Building reserves allows NFPs to weather economic downturns, invest in new initiatives, and scale their services in response to rising demand.

- Invest in Infrastructure: Much like businesses, NFPs need to invest in infrastructure, technology, staff development, or operational improvements. These investments can lead to greater efficiency and long-term cost savings, ensuring more funds are directed toward the mission.

- Diversify Income Streams: NFPs can use business-like strategies to diversify revenue, reducing reliance on volatile donations and grants, whether through social enterprises or other entrepreneurial efforts.

- Drive Innovation: By adopting the risk-taking mindset often found in business, NFPs can innovate how they deliver services, engage with communities, and tackle complex social issues. This flexibility allows them to adapt to changing environments and seize new opportunities.

The Role of Accountants and Financial Expertise

Just as businesses rely on financial professionals to ensure their growth and stability, NFPs can benefit from the expertise of accountants and CFOs. Financial professionals provide critical insights that empower NFPs to adopt business-like strategies while maintaining compliance with regulations and ethical standards.

As NFPs face increasing scrutiny and rising expectations, adopting business principles is no longer an option—it’s a necessity for future resilience.

Our team works with clients to ensure NFP and charities are fit for purpose, now and in the future. Contact us to find out more.

Download our handy infographic: